Complete Guide To Financial Software Development

Financial software development empowers fintech firms to streamline processes, boost security, and deliver personalized financial solutions to customers. Partnering with a reliable AI fintech development company ensures scalable, compliant, and future-ready platforms.

Traditional paperwork and siloed processes are a thing of the past for Fintech. Manual transactions that took hours and outdated legacy systems are no longer accepted in a digital environment where customers expect quick transactions and a seamless banking experience.

This growing demand creates room for financial software development, which acts as a strategic priority for fintech companies, banks, investment firms, and more. As per a report from BCG, financial technology revenues are projected to grow sixfold from $245 billion to $1.5 trillion by 2030, underscoring the growth potential for digital financial solutions.

Organizations are seeking expertise from a financial software development company to stay competitive in the market and build secure and compliant financial software. From streamlining financial transactions to securing payment gateways and fraud-detection systems, with the right software, you can enhance the customer experience and propel innovation.

Generate

Key Takeaways

Generating...

Generate

Key Takeaways

Generating...

- Financial software development streamlines processes, enhances security, and improves customer experience.

- Modern platforms integrate AI, Generative AI, and predictive analytics to deliver smarter, more personalized services.

- Core features include secure transactions, account management, regulatory compliance, and more.

- Regulatory adherence (AML, GDPR) and AI governance are critical for legal compliance.

- Partnering with an AI fintech development company enables scalability, innovation, and a competitive edge in the financial industry.

Well, here is a comprehensive guide that helps you explore the essentials of financial software development, the technologies that power it, how to develop financial software efficiently, and a lot more.

What Exactly is Financial Software Development?

It is the process of designing and building software that specifically meets the needs of the financial sector. The solutions help firms manage complex financial operations, automate routine tasks, and ensure security and compliance needs.

Investment firms, banks, and fintech startups rely on these solutions to manage payment processing, asset management, risk assessment, and fraud detection. It requires developers to have a clear understanding of the industry, regulations, and data management standards. Therefore, it is vital to hire an AI fintech development company that can help you build the right and intelligent solutions that meet the regulatory requirements.

Key Benefits of Financial Software Development Include:

- Automation of financial processes to reduce human error

- Real-time data processing to ensure faster decision-making

- Improved security and compliance with industry regulations

- Improved customer experience with digital interfaces

Primarily, financial software development services transform traditional financial operations and streamline tasks that previously took hours.

Recommended Post: The Key Benefits of AI in Financial Compliance

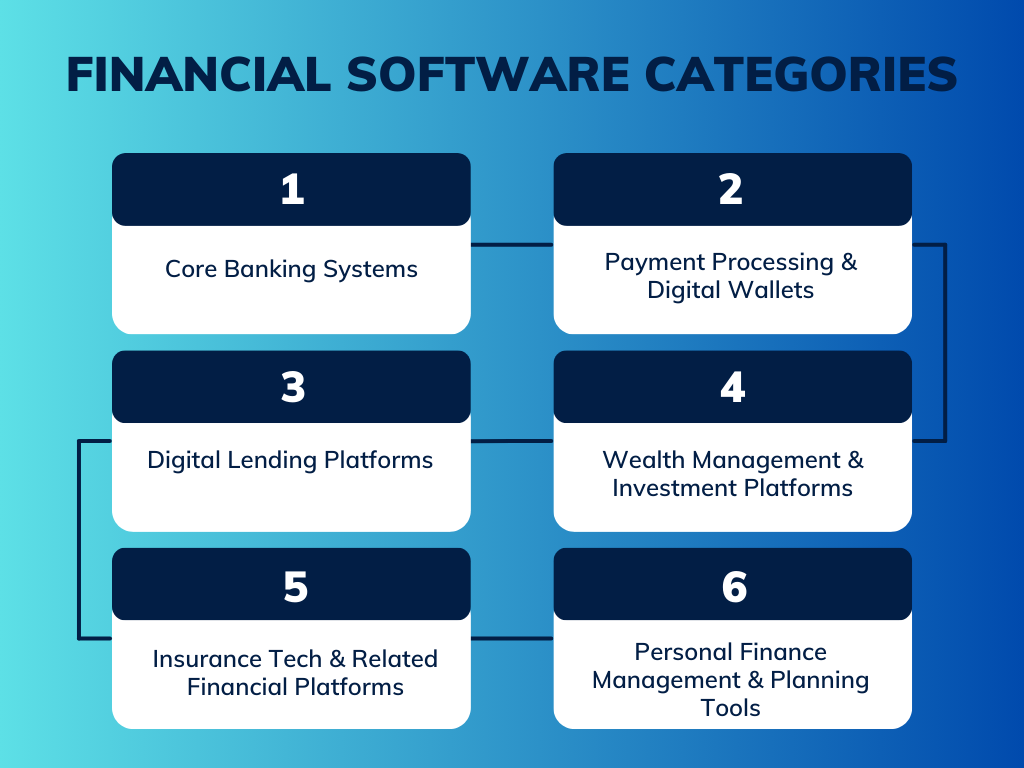

Financial Software Categories: Key Types and Solutions

Financial software isn’t one-size-fits-all. Depending on the institution’s needs, whether a bank, fintech startup, insurance firm, or investment company, there are different categories of financial software. Below are the major ones, along with market data and opportunities for businesses looking to build fintech software systems.

1. Core Banking Systems

The global market for core banking software was valued at around USD 14.85 billion in 2024 and is projected to grow to USD 38.21 billion by 2032. These are the backbone software platforms that support a bank’s or financial institution’s core operations, like account management, deposits, loans, payments, transaction processing, ledger management, and more.

A modern core banking system leverages AI and cloud infrastructure to enable real‑time processing, scalability, improved data management, and smoother integration with advanced services such as wealth management, lending, and wallets.

2. Payment Processing & Digital Wallets

As digital payments and mobile‑first banking become more widespread, payment processing platforms and digital wallets are one of the fastest-growing categories of financial software. The digital wallet adoption rate is forecast to grow globally from about 52.6% in 2024 to around 66–70% by 2029.

Payment platforms and wallets offer users the convenience, speed, and security modern customers need. It also helps businesses with new revenue streams, subscription models, and embedded finance offerings.

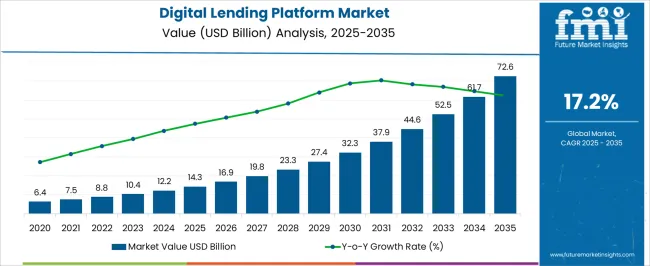

3. Digital Lending Platforms

These include software solutions for online loans, underwriting, credit scoring, loan management, repayments, and risk assessment. It simply means the transition of traditional banking or fintech lenders building modern lending services from scratch. It can seamlessly be used by small businesses, mortgages, and other loan offering platforms.

The global digital lending platform market is estimated at USD 14.3 billion in 2025 and forecast to reach USD 72.6 billion by 2035, growing at a CAGR of 17.2%.

Digital lending platforms reduce manual underwriting, speed up loan approval, increase accessibility, and enable credit to underserved populations.

4. Wealth Management & Investment Platforms

This category covers platforms for investment advisory, portfolio management, robo‑advisory, asset tracking, financial planning, and wealth management services for individuals or institutions.

AI‑powered analytics are adopted by around 52% of firms (2025), supporting data‑driven investment decisions and more efficient portfolio management. The platform can be used for retirement planning, asset allocation, and more.

By leveraging Generative AI in finance, the platforms can help firms scale advisory services to more clients at a lower cost while delivering personalized investment insights and automated portfolio recommendations.

5. Insurance Tech & Related Financial Platforms

Though insurance is not part of traditional banking, many financial software solutions now integrate with insurance companies to manage policies, claims, risk assessment, payments, analytics, and customer service. Insurtech platforms enable faster, more efficient processing, better customer experience, data-driven risk modeling, and broader access, especially for underserved or digitally‑savvy customers.

6. Personal Finance Management & Planning Tools

These are consumer-centric tools that use AI to plan their finances, empowering individuals to analyze their spending, manage multiple accounts seamlessly, save, and ensure they meet their financial goals.

As more individuals and small businesses manage finances across multiple products, bank accounts, credit cards, and investment accounts, PFM tools offer clarity, control, and simplicity.

Tired of Slow, Error-Prone Financial Processes?

Discover AI-driven financial software that automates planning, reduces mistakes, and boosts efficiency.

Why Fintech Companies Rely on Financial Software Development

In a fast-paced digital landscape, it is vital for fintech companies to choose financial software development services rather than relying on manual or outdated legacy systems. These services allow organizations to stay competitive and customer-centric. Well, there are many other benefits too. Let’s talk about them here:

1. Automation of Financial Processes

By leveraging advanced financial software development services, companies can automate routine tasks such as transaction processing, account reconciliation, loan approvals, and payment settlements, freeing staff to focus on other strategic initiatives.

2. Real-Time Data Insights

Real-time analytics allow businesses to make informed decisions without a second thought. It keeps track of customer behavior and enables organizations to make strategy adjustments, knowing what works for them.

3. Enhanced Security and Compliance

Security and regulatory compliance cannot be ignored in finance. Finance solutions offer advanced encryption, secure authentication, compliance modules, and AI governance frameworks. It helps institutions meet standards like KYC and GDPR.

4. Better Customer Experience

Customers expect seamless digital experiences. Financial software development empowers fintechs to deliver intuitive interfaces, fast transactions, digital onboarding, and personalized financial services, driving engagement and loyalty.

5. Cost Efficiency and Scalability

It reduces the operational costs as manual and monotonous work is eliminated. Moreover, scalable systems allow fintechs to expand services, handle higher transaction volumes, and integrate new features without major overhauls.

How to Develop A Financial Software

Building a financial software solution isn’t the same as building a typical app or website. Because you’re handling sensitive data, money flows, compliance, and potentially large numbers of users, you need a robust, well‑planned development process. Here’s how you should approach it:

1. Discovery & Requirement Gathering

It is the first and foremost step where you need to gather all the requirements from the client, including what problem the software solves, who will be using it, workflows needed, and more. Have a clear understanding of all the functional and non-functional requirements, like user flow, volume of transactions, and compliance needs. Whether you are developing a solution for seamless payments, accounting, lending, or more, a clear understanding will help bring efficient results. Analyzing the competitors and the market is also a part of this process.

2. Planning, Prototyping & Design

Once requirements are clear, plan your development roadmap. Choose the right technology stack (backend languages, databases), decide what features go into the minimum viable product (MVP) development, and what features are planned for later implementation. Create UI/UX wireframes and prototypes. A user‑friendly, intuitive interface is especially important for financial software, since users often deal with complex data and transactions.

3. Development & Secure Engineering

The next step is to build core functionality that includes backend logic, a frontend interface, and integration with external services such as secure payment gateways. Ensure to follow a security-first development approach, as fintech is a sensitive domain, and everything must be handled cautiously. Given the sensitivity of financial data and operations, implement encryption, multi‑factor authentication, tokenization, secure APIs, and apply secure coding standards.

4. Testing, Quality & Compliance Checks

Rigorous testing is essential in financial software, including functional testing, integration testing, performance testing, security testing, and AI-driven financial compliance audits. Finance is a sensitive domain, and errors can lead to serious consequences. Involve domain experts like compliance officers and financial auditors during testing, especially when validating transaction flows and audit trails.

5. Deployment and Post‑Launch Maintenance

During deployment, ensure the infrastructure is secure. Integration with payment networks usually requires compliance validation. After launch, continuous monitoring is critical; therefore, schedule regular security audits, patches, and updates. Gather user feedback, monitor analytics, and iteratively improve/expand features.

Key Features of Financial Software Development

|

Feature Category |

What it Includes |

Why it Matters |

|

User Authentication & Access Control |

MFA, role-based access, biometrics |

Prevents unauthorized access to sensitive data |

|

Secure Transactions and Payments |

Instant transfers, payment gateway integration, and PCI compliance |

For seamless financial operations |

|

Account & Financial Data Management |

Balance tracking, statements, automated reconciliation |

Improves accuracy for users and auditors |

|

Regulatory Compliance & Audit Trail |

KYC/ /AML flow, encrypted logs, |

Reduces legal risk while meeting local/global regulations |

|

Reporting & Analytics Dashboards |

KPIs, metrics, insights, and custom financial reporting |

Improves decision-making and operational intelligence |

|

Integration Capabilities |

Banking APIs, credit bureaus, and identity verification |

Ensures interoperability with existing financial systems |

|

Customer Communication/Notifications |

Alerts, messaging, email/SMS, |

Improves engagement and reduces friction for end-users |

|

Role-Based Permissions |

Admin/user hierarchies, authorization workflows |

Controls sensitive operations and avoids internal fraud |

Advanced Features in Financial Software Development

AI-Based Risk Assessment & Credit Scoring

AI evaluates borrower profiles using real-time financial behavior, improving underwriting accuracy and reducing default rates. This is extremely useful for lending platforms and digital banking apps. With Agentic AI in finance, you can make autonomous recommendations and optimize decision-making, further enhancing risk assessment and operational efficiency.

Fraud Detection & AML Automation

AI and machine learning continuously monitor transactions, identify suspicious patterns, and flag anomalies instantly. This reduces fraud losses and simplifies AML compliance, making financial software more secure and trusted.

Related Read: Revolutionizing Risk and Fraud Detection

Generative AI for Personalized Advisory

Generative AI drafts personalized financial plans, summarizes risk reports, and enhances chatbot support. This lowers advisory costs and improves customer satisfaction, a major win for wealth management and investment apps.

RPA for Operational Automation

RPA plays a critical role in fraud detection. It also helps automate routine workflows like reconciliation, claims verification, and reporting. Financial institutions reduce manual work, improve accuracy, and scale efficiently.

Predictive Analytics for Smarter Decisions

Predictive models help forecast credit risk, detect fraud patterns, and anticipate customer needs. This makes fintech platforms more proactive and customer-centric.

AI Governance and Compliance Intelligence

AI governance features track decision transparency, reduce algorithmic bias, and simplify compliance reporting. As regulations evolve, this becomes a critical differentiator for any financial software development company.

Scale Your Fintech with Smart Automation

Explore how AI, RPA, and predictive analytics can streamline your operations and boost decision-making.

How Much Does Financial Software Development Cost?

The cost of financial software development varies widely depending on complexity, features, and compliance needs. A simple digital wallet may cost less than a full-fledged core banking system or integrating advanced technologies like AI.

Factors Influencing Cost

1. Platform and Technology Stack : Web, mobile, or cross-platform solutions, as well as the choice of backend and frontend technologies, can impact development costs.

2. Features and Integrations: Payment gateways, banking APIs, KYC/AML compliance modules, AI-powered analytics, and reporting dashboards all add to the cost.

3. Security and Compliance: Financial software requires advanced encryption, secure authentication, audit trails, and regulatory compliance. Incorporating AI governance and Agentic AI features may also increase investment, but ensure long-term reliability.

4. Design and User Experience: A user-friendly, intuitive interface is crucial for top fintech apps and can influence project costs.

5. Maintenance and Updates: Post-launch support, bug fixes, and more contribute to ongoing expenses.

Estimated Costs

- Basic Fintech App (e.g., payment or wallet app): $20,000 – $50,000

- Medium Complexity Platform (e.g., lending, PFM): $50,000 – $150,000

- Enterprise-Grade Financial Software (core banking, full AI integration): $150,000 – $500,000+

Investing in financial software development services ensures your platform is secure and compliant while delivering a strong ROI. Partnering with a financial software development company helps optimize costs and accelerate time-to-market.

Final Thoughts

As the demand for financial services continues to rise, it becomes vital for organizations to consider financial software development as a priority. Not only does it streamline transactions, but it also enables fast decision-making and superior customer experience.

What matters most is choosing the right and reliable AI fintech development company. Collaborate with us as a leading partner and streamline your financial operations, scale your app for a million users, and keep your business ahead of the competition.

Frequently Asked Questions

Have a question in mind? We are here to answer. If you don’t see your question here, drop us a line at our contact page.

How long does it take to develop a Financial Software Solution?

![]()

Well, there is no defined timeline to develop a financial software solution. There are several factors that affect the time it would take to create the solution. A few of the factors include app complexity, integrations (APIs or payment gateways), and more. A basic app may take around 3-4 months, and a complex one may take around 6-9 months.

What Advanced Technologies are Integrated into Modern Financial Software?

![]()

Modern platforms often use AI, RPA, predictive analytics, and blockchain. These technologies enable smarter decision-making, personalized advice, automated operations, fraud detection, and compliance management.

How can a Fintech Company ensure compliance while developing Financial Software?

![]()

Financial software must adhere to regulations like PCI DSS, KYC, AML, and GDPR, along with AI governance protocols. Incorporating compliance checks into the software design helps fintechs reduce risks and avoid costly penalties.

%201-1.webp?width=148&height=74&name=our%20work%20(2)%201-1.webp)

.png?width=344&height=101&name=Mask%20group%20(5).png)