RPA in Fraud Detection: A Complete Handbook for Fraud Detection

Explore the comprehensive handbook on RPA in Fraud Detection, delving into the advanced capabilities of Robotic Process Automation in identifying and preventing fraudulent activities. Discover the benefits, challenges, and best practices for implementing RPA to enhance fraud detection strategies effectively. Learn how RPA can streamline fraud detection.

Fraud detection is a critical aspect of the financial industry, as it helps organizations protect their assets, maintain compliance, and safeguard their reputation. With the increasing complexity of fraud schemes and the rapid evolution of technology, organizations are turning to Robotic Process Automation (RPA) to enhance their fraud detection capabilities and improve the efficiency of their processes.

This comprehensive guide will explore the benefits of RPA in fraud detection, its functions, challenges, and best practices for implementing it effectively in your organization.

What is Robotic Process Automation (RPA)?

In the realm of fraud detection, Robotic Process Automation (RPA) emerges as a transformative force, reshaping traditional approaches to identifying and mitigating fraudulent activities.

RPA represents an innovative technology that leverages software robots, or 'bots,' to automate repetitive, rule-based tasks in a variety of business processes.

In the context of fraud detection, this entails emulating human interactions with diverse software systems to streamline data collection, validation, and analysis.

By seamlessly integrating with existing systems, RPA significantly enhances the speed and accuracy of fraud detection processes, empowering organizations to stay ahead of increasingly sophisticated fraudulent schemes.

However, to put it mildly- it's a very limited understanding of RPA. To understand Robotic Process Automation in its essence, including challenges, use cases, different applications, and more- head over to this in-depth RPA guide we did a while back.

What Are the Functions of RPA in Fraud Detection?

RPA functions in fraud detection by automating repetitive tasks, analyzing large volumes of data, identifying patterns, and flagging potential fraudulent activities in real time. It enhances efficiency, accuracy, and real-time monitoring, enabling organizations to promptly address potential fraudulent behaviors while minimizing the risk of human error with the help of an address checker.

Here's how RPA functions in Fraud Detection:

-

Automated Data Analysis: RPA streamlines the analysis of vast datasets, enabling efficient identification of irregularities and potential fraudulent patterns within transactions and customer behaviors.

-

Real-time Monitoring: RPA continuously monitors transactions, swiftly identifying and alerting on potential fraudulent activities as they occur, allowing for immediate intervention.

-

Enhanced Accuracy: RPA's automation minimizes the risk of human error, ensuring a higher degree of accuracy in detecting and preventing fraudulent behaviors.

-

Task Automation: RPA automates repetitive tasks involved in fraud detection, freeing up human resources to focus on more complex and strategic aspects of fraud prevention.

-

Scalability: RPA can efficiently handle large volumes of data, making it scalable for organizations with high transaction volumes and diverse data sources.

-

Cost Efficiency: By automating fraud detection processes, RPA reduces operational costs associated with manual data analysis and investigation, driving overall cost efficiency.

-

Faster Response Times: Operating 24/7 without breaks, RPA allows for real-time fraud detection and response, crucial in preventing significant damage.

Overall, RPA optimizes fraud operations by automating manual tasks, improving data accuracy, and accelerating the identification and response to fraudulent activities, ultimately strengthening an organization's defense against financial fraud.

Challenges of Implementing RPA in Fraud Detection

Implementing Robotic Process Automation (RPA) in fraud detection can provide numerous benefits to organizations, but it also comes with its own set of challenges. Here are some of the key challenges of implementing RPA in fraud detection.

- Data Security and Privacy: Strict privacy and security of data policies must be followed when implementing RPA, particularly when managing sensitive data connected to fraud detection.

- Integration with Current Systems: It might be difficult and need proper planning to integrate the RPA solution with existing databases, reporting systems, and fraud detection technologies

- Regulatory Compliance: Banks and other financial institutions must make sure that their RPA systems are safe, trustworthy, and in compliance with any relevant laws. RPA implementation also requires adherence to these regulations.

- Monitoring and Maintenance: To ensure maximum efficiency, the RPA system's performance must be continuously monitored. Prompt problem-solving is also necessary to prevent delays in the fraud detection process.

- Customization and Configuration: It can be difficult and time-consuming to modify an RPA solution to meet an organization's unique fraud detection needs.

- User Training and Onboarding: It can be difficult to connect employees with the new procedures and train them on how to use the RPA system properly.

By understanding these challenges and implementing best practices, organizations can successfully leverage RPA in fraud detection to enhance their capabilities to identify and prevent fraudulent activities more effectively.

Best Practices for Implementing RPA in Fraud Detection

Even though using robotic process automation (RPA) for fraud detection has several advantages for businesses, there are drawbacks as well. The following are some recommended strategies for using RPA in fraud detection:

-

Understanding Fraud Detection Processes: Before implementing RPA, gain a thorough understanding of existing fraud detection processes, including manual tasks, data sources, and key stakeholders.

-

Selecting the Right RPA Tool: Choose an RPA tool that aligns with your organization's needs, considering factors like scalability, security features, and ease of integration with existing systems.

-

Ensuring Data Security & Compliance: Implement RPA solutions that adhere to data protection regulations and ensure secure data handling.

- Identifying Automation Opportunities: Identify repetitive and rule-based tasks in fraud detection that can be automated using RPA, such as data collection, validation, and generating alerts.

-

Pilot Testing and Proof of Concept: Conduct pilot tests and create proof of concepts to validate the effectiveness of RPA in fraud detection before full-scale implementation.

-

Customization and Configuration: Tailor the RPA solution to suit your organization's specific fraud detection requirements, incorporating relevant fraud rules and triggers.

-

Integration with Existing Systems: Integrate the RPA solution seamlessly with existing fraud detection tools, databases, and reporting systems to ensure a cohesive and efficient workflow.

-

Monitoring and Maintenance: Continuously monitor the RPA system's performance and address any issues promptly to ensure smooth operations and minimal disruptions.

-

Performance Optimization: Regularly assess the RPA implementation to identify opportunities for further optimization and improvement in fraud detection efficiency.

-

Collaboration and Feedback: Encourage collaboration between RPA developers, fraud analysts, and stakeholders to gather feedback and insights for continuous enhancement.

Here's How RPA Can be Beneficial in Automating Fraud Detection

-

Automating repetitive tasks: RPA can be programmed to perform tasks like data collection from various sources, such as transaction logs, databases, or financial records. By automating these tasks, the process becomes more efficient and less error-prone.

-

Data validation: RPA bots can be designed to validate data against predefined rules or patterns. This ensures that the data used for fraud detection is accurate and consistent.

-

Data analysis: RPA can be used to analyze vast amounts of data quickly and efficiently. By automating data analysis, potential fraud patterns can be identified faster, leading to more timely and effective fraud prevention.

-

Faster response times: RPA's ability to work 24/7 without breaks allows for real-time fraud detection and response. This agility is crucial in preventing fraud before it causes significant damage.

-

Alert Generation: RPA swiftly identifies suspicious activity and sends alerts to personnel for investigation and action.

-

Case Management: Bots track fraud investigations, generate reports, and escalate issues to senior management.

-

Improved accuracy: RPA reduces the chances of human errors that can occur during manual data processing. This enhances the accuracy of fraud detection algorithms and reduces false positives.

By leveraging RPA in fraud detection, organizations can enhance their capabilities to identify and prevent fraudulent activities more effectively, thus safeguarding their assets and reputation.

How RPA is Used to Fight Financial Fraud?

Contrary to popular belief, you can’t substitute your entire workforce for RPA bots. That is to say, if you believe that you could assign a desk to the Robocop and profit from its benefits- you’re probably mistaken.

As stated above, RPA refers to the software bots that automate repetitive, and mundane tasks that are too monotonous for any human.

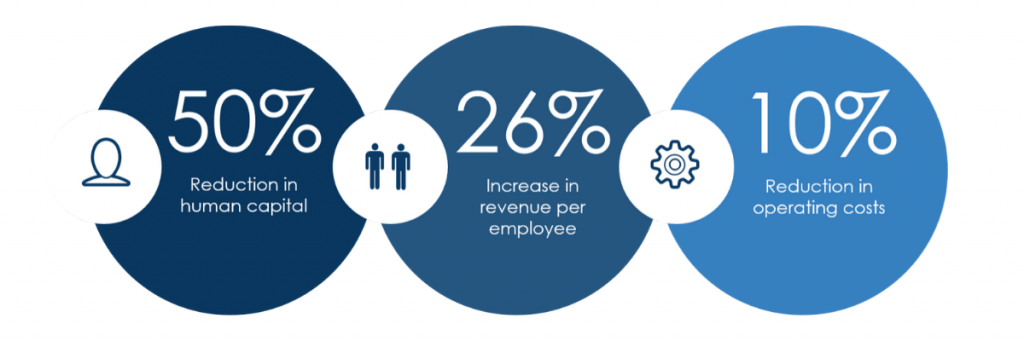

The benefit? Cheap solution. Faster Processes. No Clerical Errors.

Introducing automation technologies to the financial aspect of any business implies leveraging their cognitive capabilities, and training RPA bots to search for and scrutinize processes that involve identifying, tracking, and flagging fraudulent activities.

How RPA Can Help Mitigate Fraud Risks?

1. Reassessing Current Processes

RPA bots can be automated to review current and former financial transactions, on a timely basis, to identify uneven patterns indicating illegal (often fraudulent) activities and piracy.

Even If we were to consider a general case scenario:

RPA implementation requires financial institutions to thoroughly understand, document, and evaluate the processes that present the highest cost-benefit potential.

As financial professional goes through these stages, they develop deeper insights into business processes and identify high-risk financial areas.

Either way, these efforts assist business instigators and financial professionals to identify vulnerabilities and curb fraud in business processes.

2. Eliminating Human Errors

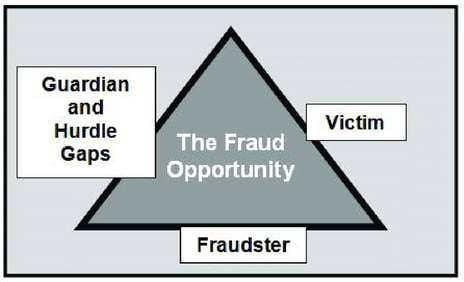

It’s preemptive to identify the right opportunities to conduct financial fraud. In simple terminology-

For such opportunities to arise, employees either have to constantly interact and tinker with financial processes, or miss out on subtle yet critical details- creating a gap.

These gaps, if and when identified, could result in massive financial losses, and in worse-case scenarios- force businesses to dissolve assets and terminate their operations.

However, when a business strategically integrates RPA into well-thought-out and designed business processes, human interaction is significantly diminished.

The result?

Business employees can shift their focus to other high-priority tasks, limiting interaction with high-risk processes that involve numbers, and other critical data.

An added benefit- with lower human interactions there’s a significant drop in clerical errors.

3. Enhanced Trade Monitoring

With money laundering on the rise, major industries, and even Nations are taking intelligent automation initiatives to battle financial terrorism and money laundering. Which technology do you think these entities employ to tackle these financial frauds?

RPA bots, when integrated with other automation technologies, can evaluate transactions for potential fraud, and flag high-value transactions in perilous sectors/areas.

4. Automate Temporary Block Removals

Banks operate and handle hundreds and thousands of accounts- a majority of which remain sedentary for months on end. At times, when banks suspect any suspicious activity with these accounts, they place them under temporary blocks.

These temporary blocks age out, but the blocks remain- unless they are manually unblocked by financial professionals.

RPA bots can be effectively used to identify accounts with these blocks, access their past activities, and remove the restrictions. But it's only possible if the account activities comply with the established criteria for block removal.

5. Automated Threat Detection

"RPA bots work exceptionally well with structured data."

Monitoring thousands of websites is a big deal for a human but is comparatively nothing for an RPA bot. Let’s take two case scenarios where RPA can assist with automated threat detection:

6. Copyright Infringement

RPA bots prevent copyright infringement by quickly monitoring the suspected websites for your patents, trade secrets, and other crucial data. Much like copyright monitoring software scans the internet for unauthorized use of protected content, RPA bots automate the detection of potential IP violations in real time.

7. Product Pricing

To boost sales, several companies might sell your products at a lower price (one that’s technically not feasible to match). RPA bots collect and aggregate pricing data, to check if your offerings are being unethically sold online or below the set MSRP.

Is RPA the Best Solution for Fraud Detection?

We wish the answer was a plain yes or no, but RPA crosses the box for both classifications when it comes to fraud detection.

RPA started as a basic automation technology but has evolved into a full-fledged autonomous automation system- capable of understanding unstructured data and calling the shots.

If we take simple RPA automation, it might not be as effective for detecting fraud or recording uneven patterns. But things take a turn when we employ these simple RPA bots, but with machine learning capabilities.

Machine learning algorithms perform consistent tests, with the sole purpose of identifying abnormalities in transactions, and associated patterns; enhanced cognitive abilities are what help these bots to decipher and report these financial anomalies as fraudulent activities.

The Future of RPA in Fraud Detection

The future of RPA in fraud detection is promising, as advancements in technology continue to enhance its capabilities. Here are some key trends and developments that are shaping the future of RPA in fraud detection:

- Cognitive Abilities: RPA systems with advanced cognitive capabilities will be able to analyze patterns, identify trends, and detect anomalies more effectively, reducing false positives and improving the overall accuracy of fraud detection.

- Integration with Machine Learning and AI: The combination of RPA with machine learning and artificial intelligence will enable organizations to leverage advanced analytics and automate complex tasks, enhancing their fraud detection capabilities.

Conclusion

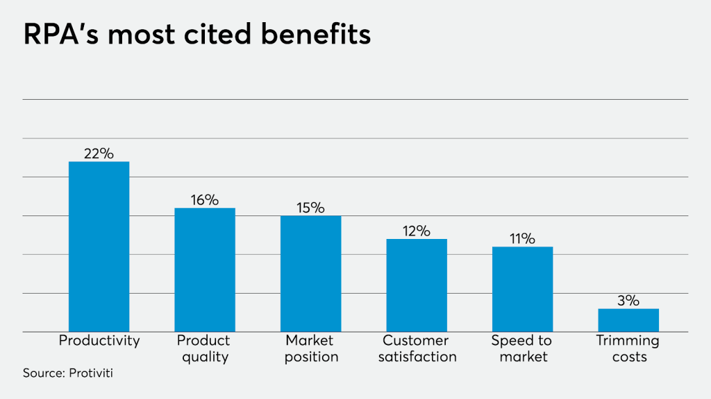

Organizations have a great chance to improve their fraud detection skills using robotic process automation. Organizations can improve efficiency, accuracy, and real-time monitoring in detecting and stopping fraudulent activity by using RPA.

The adoption of best practices, an organized approach to problem-solving, and a dedication to ongoing improvement are necessary for successful deployment. Organizations can use RPA to remain ahead of the fraud game if they have the correct plan in place.

Although a little expensive in the initial implementation phases, RPA offers banks, financial institutions, and even your business a competitive edge. It not only helps with fraud detection but ensures that your business ignores futile attempts, keeping costs at a bare minimum.

Frequently Asked Questions

Have a question in mind? We are here to answer.

Which processes can be automated using RPA?

![]()

- Customer service.

- Invoice processing.

- Boosting productivity.

- Employee onboarding.

- Payroll.

- Storing information.

- Analytics.

What technology is used in fraud detection?

![]()

Deploying Artificial Intelligence, (or AI), for fraud prevention has helped companies enhance their internal security and streamline business processes. Through improved efficiency, AI has emerged as an essential technology to prevent fraud at financial institutions.

How do you automate fraud detection?

![]()

%201-1.webp?width=148&height=74&name=our%20work%20(2)%201-1.webp)

.png?width=344&height=101&name=Mask%20group%20(5).png)