Automating Invoice Processing with RPA - A Game Changer

Are you looking to add automated invoice processing to your arsenal of tools? Maybe for your business or personal use, whatever it is - it’s always a good idea to have an in-depth understanding of the investment made.

To your surprise, 81% of digital enterprises using digital payables platforms witnessed 81% lower processing costs and 73% faster processing cycle time.

And the good news isn’t just about money.

The advantages of automation of the billing process also emerge in terms of quality and efficiency. After all, RPA (Robotic Processing Automation) of any basic task improves quality, accuracy, and compliance by more than 90% and productivity by 86%.

Moreover, 78% of companies who are already leveraging the benefits of invoice automation expect to maximize their investments in the next three years.

Though these are all promising numbers, most companies don’t know how to ride this bandwagon. We’ve sketched this article on relevant experience working with clients who look to reengineer their invoice processing, but still sit on the fence.

Companies looking to transition from traditional invoicing to an automated invoice processing system

with sample invoices. These templates provide a practical perspective on the information layouts that need accurate data handling facilitated by RPA.

If somehow you are doing things the old way, it’s time to catch up with time and adapt to RPA. Explore everything about RPA and how industries are leveraging its benefits.

We’ll cover:

- The steps are taken to automate invoice processing workflow

- The features and challenges of invoice automation

- The key consideration for successful RPA implementation

- The key trends in RPA finance

So let’s swoop in!

Challenges in the Account Payable Process

When it’s all about billing processes, the most common challenges are related to the nature of the processes and the time.

Simple categorization may seem like this:

-

Repetitive Manual Tasks and High Scope of Error

Downloading invoice attachments from emails, reading them, and then filling up the data into the enterprise resource planning system. Besides taking your employees' precious time in this repetitive time, the nature of the activities brings additional fatigue and stress for them.

-

Service Level Agreement Breach

Several approvals related to invoice processing often lead to the complete slowing of the billing cycle and penalties.

-

Slow Cycle Time

Invoice processing consumes more time because of the manual approvals and activities that are interdependent on several organizational roles and responsibilities. Besides, it can bring dissatisfaction with service quality.

-

Invoice to Payment Mismatches

Invoice mismatching is a significant activity in accounts payable. But, conventional approaches to these vital tasks may cost time, effort, and human resources, accompanied by inconsistencies and errors.

Here, we'll explore the capabilities of Robotics Process Automation for optimizing invoicing workflow.

Manual vs Automated Invoice Processing: A Clear Contrast

Before adopting invoice automation, many businesses still struggle with high costs and long cycle times. According to 2025 research, 68% of companies still enter invoice data manually, and the average cost to process one invoice manually is about $15, often taking 14.6 days from receipt to payment.

By contrast, modern invoice workflow automation, especially when using RPA, dramatically reduces both time and cost. Organizations that implement end-to-end invoice automation typically cut invoice approval cycles to just 3–4 days. Moreover, they reduce processing costs by up to 70–80%, enabling better cash flow management and lower error rates.

This before vs after view gives businesses a measurable framework to evaluate whether automating invoice processing will deliver real ROI rather than just incremental improvement.

What is Invoice Processing With RPA?

Invoice processing + RPA = “Invoice Processing Automation”.

Invoice processing automation is used by businesses to optimize AP (Account Payable) processes. It sheaths everything from scanning and extracting invoice data, to seamlessly inputting data into an ERP or accounts payable system.

The outcome is the potential to complete payments within minutes.

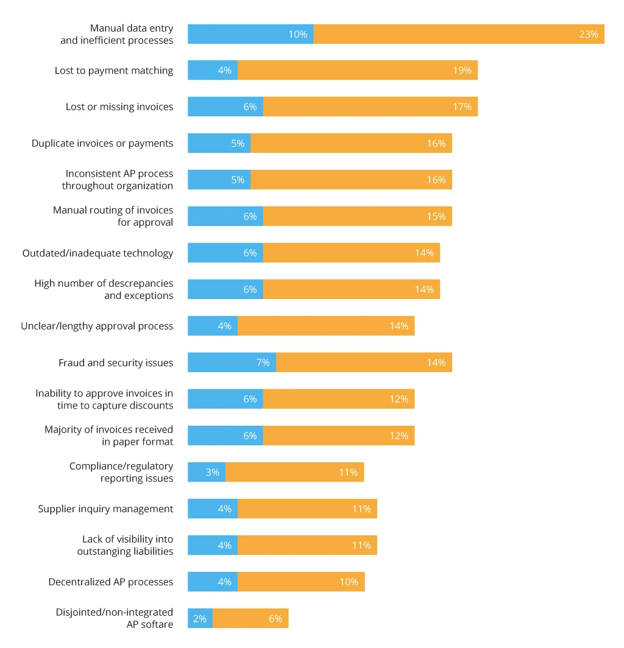

Furthermore, automated invoice processing helps address crucial challenges in manual AP processing. You can see from the below statistics, the complexity of managing account payables increased exceptionally during the COVID-19 times.

Undoubtedly, businesses and organizations actively adopt numerous invoicing automation tools, especially RPA (Robotics Process Automation), during and after epidemic time.

“RPA in Invoice Automating” is a trusted solution for rule-based process automation that uses the user interface and can run on any software like ERP systems or web applications. Besides, compared to other technologies like BPM (Business Process Management), RPA offers financial and operational advantages faster than going easy on the pocket.

Businesses integrate RPA to bring automation to the following areas of finance operations:

- Account Payable: It includes extracting invoice data, vendor validation, and vendor invoice processing.

- Account Receivable: This includes customer data setup, management, monitoring customers’ credit status, and generating and distributing invoices.

- Financial Reporting: This is about producing balance sheets, profit and loss reports, regulatory reports, and income statements.

- Intercompany Reconciliation: Reconciliation means extracting and verifying data from files, exception handling and monitoring, and validating journal entries.

There’s more RPA can do!

Robotics process automation transforms finance operations functions in the middle- and back-office operations.

Checklist to consider when adopting RPA for invoice automation:

- The requirement for high-level precision and consistency.

- Highly dependent on data manipulations, data entry, and generating reports.

- Need to collect information from several sources and systems.

- Repetitive and manual nature of numerous processes that can be easily automated.

- The need to adhere to strict regulatory requirements.

Notably, considering the automation purpose and complexity of the process, RPA can be used solely or can be easily amalgamated with technologies like AI (Artificial Intelligence), NLP (Natural Language Processing), Machine Learning, and IDP (Intelligent Document Processing).

In simple terms, every combination offers unique benefits, but first and foremost, invoicing automation allows employees to dedicate time and effort to crucial tasks, bringing more value to the company.

The Full Invoice Automation Lifecycle (Invoice Workflow Automation)

To understand why invoice process automation is transformative, it helps to visualize invoice lifecycle automation from start to finish. In a fully automated workflow:

- Invoice Intake: Invoices arrive through emails, portals, or EDI feeds and are automatically captured.

- Data Extraction & Classification: Intelligent systems extract invoice fields such as vendor, PO number, and line totals.

- Validation & Matching: Invoice data is automatically matched against purchase orders and receipts.

- Exception Handling: Any discrepancies are flagged and routed for human review.

- Approval Routing: The system automatically routes the invoice for approval based on predefined rules.

- ERP Posting & Payment: Approved invoices are posted into ERP and scheduled for payment with complete audit trails.

This full-cycle automation reduces the average approval time from over 10 days to just 3 days, significantly accelerates the invoice-to-cash cycle performance, and increases data consistency and compliance visibility.

With this, let us quickly jump to the next question.

How does RPA automate the Invoicing Process?

Let’s see!

To automate invoice processing, an RPA will typically take the following steps:

Step 1: Identify Invoices

The first step to automate invoice processing is to train the RPA bots to identify these invoices, whether that’s through a dedicated vendor portal, EDI (Electronic Data Interchange), emails or all of them.

Step 2: Extract Relevant Data

After identifying an invoice, the RPA bots scan it and organize data to copy it precisely into other apps and systems like accounting software or ERP. Besides, data recognition often needs AI elements, like NLP or computer vision, for advanced cognitive capabilities that let bots identify and classify key data regardless of the invoice format.

Step 3: Match Invoice with PO (Purchase Order) and Documents

RPA bots easily compare line items between invoices and related account payable documents, like purchase orders (PO) or goods receipts. Furthermore, they verify the information on both ends and even notify vendors of any mismatch.

Step 4: Handling Exceptions & Edge Cases in Invoice Automation

Even the best automation workflows face exceptions such as missing purchase orders, incorrect item details, or quantity/price mismatches. Modern invoice workflow automation tools leverage RPA bots, combined with machine learning or OCR-based systems, to identify anomalies, automatically notify responsible stakeholders, and escalate unresolved exceptions in accordance with SLA rules.

In fact, recent industry surveys show that around 14% of invoices require exception handling due to missing data or errors, which can disrupt cash flow if not managed quickly. By automating exception handling, businesses can dramatically reduce manual rework time and minimize late payment penalties, ensuring smoother end-to-end invoice processing.

Step 5: Payments to ERPs

Once the invoice is approved and paid, RPA bots seamlessly post the payments to your ERPs - ensuring precise data and a well-defined audit log and process.

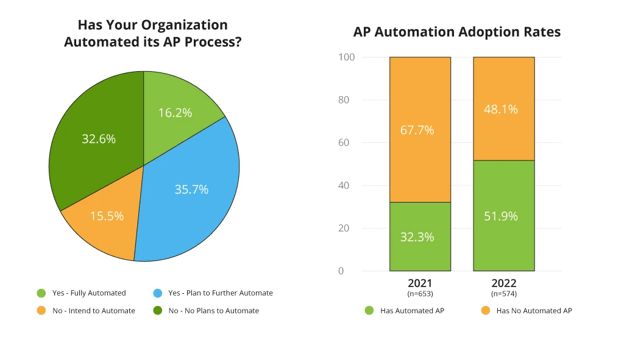

Surprisingly, the adoption of automation in invoicing grows significantly year to year. Presently, about 52% of companies automate their account payable processes.

Considering the trend, you must be wondering what benefits automating invoice processing brings.

Here’s the answer!

Benefits of Automating Invoice Processing

RPA offers several cross-industry benefits. Especially when it comes to invoicing, it offers the following advantages:

-

Increased Accuracy

Often, invoices are cross-matched to the point of sale (POs) and shipping addresses.

But, RPA helps minimize errors that happen because of missing or inaccurate information. For example, automating accounts payable and receivable with robotic process automation reduces the time for identifying and rectifying data discrepancies.

-

Zero Paper Expenditure

It’s time to say goodbye to paper!

Searching and extracting required data consumes time and effort. With RPA, there is no need to collect and archive paper records; the process also speeds up.

-

All-time Availability

Robotic Process Automation ensures round-the-clock service availability, giving non-stop performance and efficiently minimizing peak-time queues.

Moreover, it allows companies to provide enhanced customer services, handhold a competitive advantage with better customer experience and higher customer satisfaction, and actively scale operations.

-

Compliance is No More a Concern

RPA services are programmed to address all compliance rules and audit regulations. Besides, they offer access to complete maintained logs, with every step of the process recorded for quick audit.

Also, in case of any standards and regulations updates, RPA bots can be easily programmed to comply with up-to-date regulations, ensuring financial reporting meets compliance.

-

High ROI

Companies who integrate RPA services expect a substantial Return On Investment.

After all, savings made by integrating RPA justify the implementation costs. Minimizing employees’ manual efforts, decreasing invoice processing time, and adding capabilities to scale business operations seamlessly outweigh the implementation costs.

-

Phenomenal Productivity

Automating invoice processing speeds up invoice data, exporting it into the respective other systems, matching it with PO, and approving the final payments.

-

Minimized Fraud and Risks

As invoice and check exposure are minimized with built-in verification, the uncertainty of fraud is reduced significantly. Also, RPA eliminates human errors in manual invoice verification, improving early fraud detection effectiveness.

All in all, under the umbrella of invoice process automation, organizations speed up approval cycles, minimize invoice processing costs, improve auditing and reporting precision, and so on.

This is why automation has been curated as one of the key drivers in the technological and operational upgrades of financial units across industries.

Without a doubt, RPA invoice process automation helps businesses accomplish flawless accuracy, improve customer experience, and leverage other advantages from automation. And, successful implementation of RPA funnels to in-depth business analysis of specific business goals, and crafting a solution that streamlines achieving them.

Also Read: Most common use cases of RPA in finance and accounting.

Cost, ROI & Time-to-Value of Invoice Process Automation

One of the most compelling reasons to adopt invoice process automation is quantifiable ROI. Market research shows that organizations implementing automated invoice solutions often realize 300–600% return on investment within the first year due to labor reduction, improved accuracy, and faster processing cycles.

In addition, automation typically takes 3–6 months to implement and start showing returns, depending on the existing systems and invoice volumes.

On the cost side, invoice automation process efficiencies can lower processing costs significantly from an average of $15 per manual invoice down to under $3 per automated invoice for best-in-class teams.

This reduction in cost per invoice not only improves profitability but also enhances supplier relationships by enabling more reliable and timely payments.

Here are two amazing use cases of RPA for invoicing from our stack.

RPA Use Cases for Invoice Processing in 2026

RPA remains one of the most leveraged technologies for invoice processing due to its ability to automate repetitive, rule-based tasks. In 2025:

- 78% of organizations using RPA report significant reductions in processing time.

- Up to 80% of repetitive finance tasks can be automated with RPA bots.

- Over 85% of businesses say RPA has improved their operational efficiency.

Common RPA use cases for invoice processing include:

- Automated extraction and classification of invoice data

- Three-way match (invoice, purchase order, receipt) processing

- AI-assisted error detection and exception routing

- Approval workflow automation across departments

- Posting confirmed invoices and payments to ERP systems

These use cases aren’t theoretical; they represent what finance teams are actively automating today to reduce costs, improve compliance, and elevate strategic workload. Here are two amazing use cases of RPA for invoicing from our stack.

The RPA-based Invoice Automation Process Implementation Use-Cases

#Case 1: Advanced Invoice Process Automation with AI and IDP (Intelligent Document Processing)

In a handful of scenarios, more than standard RPA integration is needed to automate invoicing.

Considering the workflow, a solution may need an additional technology stack like Intelligent Document Processing for extracting invoice data from different documents and Artificial Intelligence to process information precisely from different sources in the same format.

For one of our clients, managing invoices was a daunting workflow. Employees received invoices through emails in different formats, which were further classified and then processed according to internal standards. Here, our developed Intelligent Automation solution for clients addressed their biggest challenge, while retaining accuracy.

- The RPA bot constantly checks the email for incoming invoices.

- It extracts new invoices and collects them into a database.

- The collected invoices are directed into a queue for recognition by the Document Understanding algorithm. Further, the files are classified according to the file type and the number of invoices it has.

- Next, a notification is sent to the user to verify the data. In this, the user can validate the amount and category through a user-friendly interface, plus can make changes and corrections in the invoice category, if needed.

- After approving the request, a bot either enters data into the ERP and performs tax imputation or vice versa.

- Lastly, a bot assigns barcodes to every invoice entered.

Tech-Stack Used - UiPath, Data Service, Action Center - for request approval, Document Understanding.

Outcome:

- The invoicing process is 90% automated.

- Employees are responsible for data verification and making amendments.

- Data recognition accuracy improved to 90%.

#Case 2: Standard RPA Solution for an IT Service Provider

The IT company has an in-house time tracking software in which each employee reports the time invested in each project. Precisely, an hour is a unit used to calculate payments, client invoices, and resource salaries.

Our developed RPA solution performs the following steps:

- All resources invested are classified based on projects, indexes, and costs to calculate the payment.

- At month’s end, the RPA bot automatically exports data for each project.

- RPA bot generates invoices for every project for different clients, including all the services.

- Each employee gets notified for request approval.

- After approval, the bot uploads information into the respective ERP system and sends an invoice to the client.

Tech-Stack Used: Standard RPA Automation (UiPath)

Outcome:

- The invoicing process is 98% automated

- Minim human-error

To put it simply, invoice processing automation is inescapable in any sphere. Though some may be improvised solely with RPA automation, others may need IA or Hyper Automation (RPA is amalgamated with AI, ML, and other cognitive technologies).

How Do We Help?

Hopefully, this article has shed light on invoice process automation and its benefits for your business. After all, in a growing competitive environment accompanied by rising interest in the digital revolution, the quicker businesses handhold automated invoicing, the faster they grow and stay afloat.

At Signity, our experience in RPA invoice automation services for enterprises across industries empowers businesses of any scale with an advanced level of automation, with up-to-date RPA, AI, and machine learning technologies for intelligent document processing and data management.

If all you want is exceptional operational efficiency for your invoice processing routine to add value to your business growth, get started quickly!

Frequently Asked Questions

Have a question in mind? We are here to answer. If you don’t see your question here, drop us a line at our contact page.

What is Invoice processing automation?

![]()

Invoice processing automation refers to the use of invoice automation software to manage and process invoices within the accounts payable process without relying on manual processes. It automates tasks such as invoice receipt, invoice data capture, data extraction, validation, and posting into accounting systems or ERP systems. By reducing manual invoice processing, businesses lower the cost per invoice, improve accuracy, and gain better control over cash flow.

How does RPA help in Automating Invoice Processing?

![]()

Robotic Process Automation (RPA) enables automated invoice processing by handling repetitive, rule-based tasks across the invoice processing workflow. RPA bots extract invoice details, validate them against purchase orders, apply predefined business rules, route invoices for approvals, and update accounting software or ERP systems. This eliminates manual data entry, reduces errors, and accelerates the approval process.

How can RPA reduce errors in Invoice Processing?

![]()

RPA minimizes manual data entry errors by automating invoice data extraction using technologies such as optical character recognition (OCR) and machine learning. It validates extracted data against vendor records and purchase orders, detects duplicate invoices, and flags exceptions for review. This significantly improves data accuracy compared to manually processing invoices, where errors are more common due to fatigue and inefficient processes.

Can RPA handle large volumes of Invoices?

![]()

Yes. RPA is designed to scale and can process thousands of incoming invoices daily without delays. Unlike manual entry, automated systems can work continuously, ensuring faster processing of vendor invoices, consistent validation, and timely approvals. This makes RPA ideal for organizations experiencing growth or seasonal spikes in invoice volumes.

What security measures should be considered when implementing RPA for invoice processing?

![]()

When implementing invoice processing automation software, security should be a top priority. Key measures include role-based access controls, encrypted invoice data, secure integration with accounting systems, activity logs for audit trails, and compliance with internal and external regulations. These controls ensure data security while managing invoices across automated workflows.

How does automated invoice processing work from receipt to payment?

![]()

An automated invoice processing system begins with invoice receipt through email, portals, or electronic invoices. Using automated invoice capture and OCR, the system extracts invoice data, validates it against purchase orders, and applies predefined rules for approval. Approved invoices are then posted to the ERP system for payment, completing the invoice automation process with minimal human intervention.

What are the key benefits of automated invoice processing for accounts payable teams?

![]()

The benefits of automated invoice processing include reduced manual processes, faster invoice approvals, lower processing costs, and improved visibility across the accounts payable workflow. Automation also helps teams capture early payment discounts, avoid late fees, and achieve improved cash flow by accelerating invoice-to-payment cycles.

How does invoice automation integrate with existing accounting or ERP systems?

![]()

Modern invoice automation solutions are designed to integrate seamlessly with popular accounting software and ERP systems. RPA bots and APIs transfer validated invoice data directly into accounting systems, ensuring real-time updates, consistent records, and a unified view of the accounts payable process without disrupting existing workflows.

How do automated invoice processing tools handle exceptions and duplicate invoices?

![]()

Invoice automation tools use predefined business rules and machine learning to identify exceptions such as missing invoice details, mismatched purchase orders, or duplicate invoice detection. These exceptions are automatically routed for review while compliant invoices continue through automated approval workflows, ensuring efficiency without compromising accuracy or control.

Why is invoice automation better than manual Invoice Processing?

![]()

Manual invoice processing relies heavily on data entry, paper invoices, and human validation, which increases processing time and error rates. In contrast, invoice processing automation replaces manual entry with automated processing, enabling faster invoice capture, improved data accuracy, better compliance, and scalable operations that support business growth.

%201-1.webp?width=148&height=74&name=our%20work%20(2)%201-1.webp)

.png?width=344&height=101&name=Mask%20group%20(5).png)